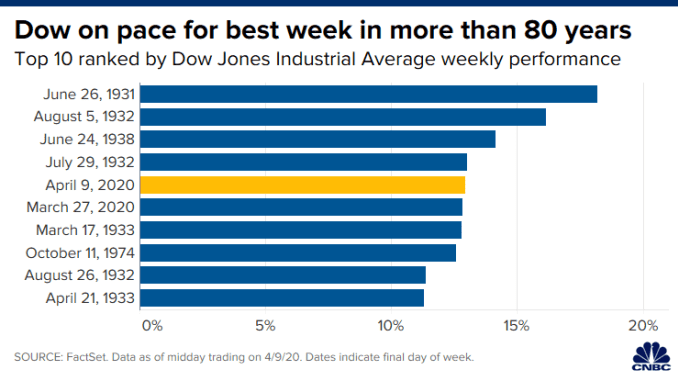

Dow jumps 500 points, heads for biggest weekly gain since 1938

The Dow Jones Industrial Average rallied on Thursday, wrapping up its best week in more than 80 years, after the Federal Reserve gave more details on how it will support the economy amid the coronavirus pandemic.

The Dow jumped 503 points, or 2.1%. The S&P 500 gained 2.2% while the Nasdaq Composite advanced 1.1%. The U.S. stock market will be closed Friday due to Good Friday. Stocks came off their highs after Democrats in Congress blocked a Republican effort for unanimous support for $250 billion in small-business aid.

Thursday’s gains put the major averages on pace for strong weekly gains. Dow was up more than 13% for the week, putting it on pace for its biggest weekly gain since 1938. The S&P 500 was up 12.8% week to date, on pace for its best week since 1974. The Nasdaq had gained 10.9% and was headed for its best weekly performance since 2008.

“It’s been a strong week in equities and probably for good reason,” said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management. “Many stocks were widely considered to be in oversold, and then you’ve got policy assistance that’s in motion at the Fed and in fiscal policy.”

“That’s clearly helping sentiment, but we still find it difficult to get overly bullish when the duration of COVID-19 remains unknown,” Sandven added.

The Fed announced as slew of programs, including loans geared towards small and medium sized businesses, that will total up to $2.3 trillion. The central bank also gave more details on its plans to buy investment-grade and junk bonds.

“This Fed is the most aggressive Fed. They do not want to be known as the reason why we went into a depression,” CNBC’s Jim Cramer said on “Squawk Box” on Thursday. “I’m very impressed. The Fed is on its game and this is what is needed because we got to fight off a depression, we got to get America open for business.”

Thursday’s announcement was enough to outweigh another massive jump in weekly jobless claims. More than 6 million Americans filed for unemployment benefits last week. Economists expected an increase of 5 million. The latest data built on the record-shattering prior two readings of 6.6 million and 3.3 million.

Virus outlook improves

Wall Street’s weekly surge comes amid increasing hope that the situation around the coronavirus was improving. In recent days, the number of new daily confirmed cases has dropped globally and in the U.S. New York state has also reported a decline in its virus-related hospitalization rate.

Treasury Secretary Steven Mnuchin also told CNBC on Thursday the U.S. economy could be re-opened in May. But some believe that stocks are now getting ahead of themselves and investors should exercise caution.

“I think this is kind of buy the rumor and potentially we sell the news when reality sets in of what we are going to see what’s on the other side,” billionaire investor Mark Cuban said Wednesday on CNBC’s “Closing Bell.”

“I think people are naturally optimistic right now in terms of the market. I just don’t think they’re really factoring in what we’re going to see on the other side,” he added.

After Thursday’s rally, the Dow is up more than 30% from its March low, but still down 16% this year.

“The stock market is at a very uncertain point now. The impact of the coronavirus on future earnings is yet to be determined. We aren’t out of the woods,” said Nancy Davis, chief investment officer at Quadratic Capital.