3 Quality Preferred Shares I Have Been Buying, Yields Up To 8%

This bear market has set a record in the rush to cash.

Even top-quality preferred shares have felt the impact.

These three picks all enjoy very strong balance sheets and substantial cash flow.

They will be trading back above par before you know it.

Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio. Get started today »

Co-produced with Beyond Saving

Every bear market is unique. There are a few things that will set this bear market apart from prior ones and likely from future ones.

The first is the incredible speed at which it developed. As the US and world economies went from 100 MPH to 30 MPH in an instant, the shock rippled throughout the market.

The second was the panicked rush to cash. Many companies drew down their lines of credit to hold cash on their balance sheets. This, in turn, caused banks, insurance companies and other lenders to raise cash in a hurry. This meant selling anything, even AAA-rated securities, at any price to ensure they had the liquidity they need.

The third was the swift response from the Federal Reserve and from governments to inject liquidity. We have seen variations of everything that was done before – the Fed buying treasuries, agency MBS and CMBS, slashing the target rate, and providing repo financing – the government offering loans, making cash distributions to individuals, extending unemployment benefits, and much more. What we have not seen is all of these things done within a month, at a scale larger and more aggressively than anything we have seen before.

At High Dividend Opportunities, we have significant exposure to preferred equity. A sector that’s normally less volatile than common equities, with less price volatility and fixed dividends that have priority over common dividends.

Like all fixed-income, preferred equity saw a major sell-off as institutions and investors sought liquidity at all costs. For income investors, this is an opportunity to buy.

Today, we take a look at three preferred shares that normally do not have a high enough yield to meet our target. Yet thanks to the sell-off, these three preferred shares have yields of 5%-8%, which is not likely to last for long. These are very conservative picks that feature very strong balance sheets and plenty of cash flows to survive any recession.

PSA

Public Storage (PSA) is in a recession-resistant business – storage properties – combined with an incredibly strong balance sheet. Demand for storage property might even go up if young adults start moving back in with families or families consolidate and need to store things.

Storage REITs, in general, have been strong defensive picks. PSA is the dominant REIT in the sector, with a market cap larger than all of its peers combined.

A strong recognizable brand name, a defensive business, a fortress balance sheet, and substantial scale makes PSA the clear “blue chip” in the sector. PSA has more than 2,400 locations around the world and converted to a REIT in 1995.

As a company, PSA has withstood the test of time, surviving and thriving despite several recessions.

Data by YCharts

Data by YChartsPSA has relied heavily on preferred shares with 11 issues currently outstanding. In fact, PSA is in the unusual position where preferred equity outstanding exceeds their total debt.

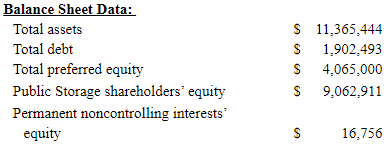

Source: PSA 10-K

Source: PSA 10-K

Since year-end, PSA did issue $555 million in additional Senior Notes, increasing their total debt to approximately $2.45 billion. For a REIT, PSA’s debt levels are extraordinarily low at only 21% of assets. If we back out real estate depreciation, PSA has more than $17 billion in assets, putting their debt under 15% of depreciated assets.

PSA’s annual EBITDA is approximately $2.05 billion, putting their debt/EBITDA at only 1.2x. In short, as preferred shareholders, we are in-line behind debt, but the line for debt is incredibly short relative to their assets.

Counting the preferred as leverage, PSA still has very modest leverage levels and debt+preferred/EBITDA at 3.18x and under 40% of under-appreciated assets.

Turning to cash flow, we see similarly strong numbers. PSA’s interest expense in only $45 million/year, while the preferred distributions are approximately $210 million/year. EBITDA covers debt + preferred payments 8.2x.

It’s very rare for a REIT to carry an A credit rating. Not only does PSA enjoy a corporate family rating of A2 from Moody’s, their preferred equity enjoys a rating of A3.

Today, we have an opportunity to buy these investment-grade preferred shares near par. PSA has a lot of great preferred picks, ours is Public Storage, 5.15% Dep Shares Cumulative Preferred Shares Series F (OTC:PSA.PF) which yields 5.15% and was trading above $27 in February.

REXR

Rexford Industrial Realty (REXR) is an industrial REIT that owns properties in southern California, from Los Angeles to San Diego. Their primary focus is industrial buildings in in-fill areas that service international shipping and warehouse needs.

The Port of Los Angeles and the Port of Long Beach are the two busiest ports in the U.S. This means that a very large amount of goods are brought into these ports, and also exported from these ports. This results in very high and very stable demand for industrial warehouses that are capable of storing goods that either just came in, or are waiting to be shipped out.

Additionally, Southern California is one of the more popular, and more expensive, places to live in the U.S. Especially within reasonable driving distance of the coast, driving up real estate values for non-industrial uses.

The result is that there’s a high demand for warehouse space and a very limited supply. Economics 101, inelastic high demand combined with low and inelastic supply is a recipe for increasing prices and increasing rent.

REXR has taken advantage of these conditions, building a portfolio of 213 industrial properties that can charge an average rent of $9.61 while experiencing same-property NOI growth of 3%-4% per year.

These properties will very likely continue appreciating in value. In real estate, it’s about location, location, location – and these properties are in a very prime location. International trade will continue to grow, these ports will continue to be the largest in the U.S. and the need for more warehouse space to manage the logistics is only going to get more extreme.

The best part is that REXR has assembled this portfolio with very little debt.

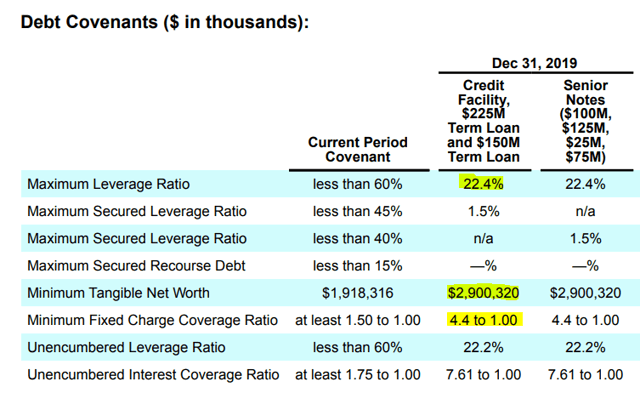

Source: REXR

Source: REXR

At only 22% of total assets, the debt level is very low for a REIT. Particularly interesting is the minimum tangible net worth requirement, which is assets that are tangible and could be converted to cash minus liabilities. The par value of outstanding preferred shares is $242 million, meaning that the preferred shares are covered nearly 12x by tangible assets after debt is repaid.

We see similarly strong coverage with cash flow, which is measured by Fixed Charge Coverage, this is interest + preferred dividends/Adjusted EBITDA. At 4.4x, REXR’s cash-flow is easily covering their interest and preferred dividends, with plenty left over for common shareholders.

The bottom line is that REXR has:

- Premium locations in a market with fundamentally strong supply/demand dynamics.

- Increasing property values and cash flow from rent.

- Very low levels of debt.

- Preferred equity that has very strong asset and cash flow coverage.

The current dividend for all of this? It’s a +6% yield.

We suggest Rexford Industrial Realty, 5.875% Series B Cumulative Redeemable Preferred Stock (REXR.PB). This cumulative preferred share is not callable until November 2022.

NLY

Annaly Capital Management (NLY) has been one of our favorite buying opportunities over the past month as the market panicked and sold off mREITs across the board.

NLY invests primarily in agency mortgage-backed securities. The “agency” part means that the principal payments are guaranteed by GSEs (government-sponsored enterprises).

Agency MBS was not exempt from turbulence caused by the race to cash, however, the Federal Reserve quickly stepped into the market and started buying. This created stability, yet share prices continued to decline.

Today, we are finding out that the market in fact was extremely wrong. NLY reported a book value decline of 21-23%, while their share price dropped over 60%.

The preferred shares experienced a decline as well, Annaly Capital Management, 6.50% Series G Fix/Float Cumulative Redeemable Preferred Stock (NLY.PG), which was trading near $26 just a couple months ago is now trading near $21.50 with about an 7.5% yield.

Due to the GSE guarantee, agency MBS carries no credit risk. The type of risk they carry is interest rate risk. They borrow short-term money and buy long-term securities. If the cost of short-term debt goes up, their profitability declines. If the cost of short-term debt goes down, it increases.

Common shares will see their book value move with Treasury volatility. As we saw last month, that can be a very fast move. For those who want to reduce risk, the preferred shares are the place to be.

NLY’s preferred shares are $1.98 billion at par value. NLY has $4.6 billion in cash and unencumbered agency assets. Agency MBS is extremely liquid and can be sold easily, even with the volatility of last month, their value declined less than 5% at their lowest point. All of NLY’s debt is non-recourse, so in a liquidation event, the preferred equity are at the front of the line for the unencumbered assets and cash.

If we consider the equity in their encumbered assets as well, NLY has over $12 billion in equity, meaning that the preferred shares enjoy asset coverage of over 6.2x.

In terms of cash flow coverage, NLY produces over $1 billion/year in net interest income. Covering their $136 million in preferred dividends over 7.3x. In 2020, with lower borrowing costs, we expect NLY to improve their margins and for cash-flow coverage to improve materially.

In short, NLY-G provides investors with an opportunity to get an 8% yield with substantial asset coverage from cash and agency MBS. Even in the most volatile MBS and treasury markets in history last month, the preferred shares were never at serious risk of being unable to receive their dividend or being easily covered by assets if NLY liquidated.

Conclusion

All three of these REITs have several things in common – they have substantial, low-risk assets supporting the preferred investment. All three are run conservatively relative to peers, have substantial cash flows and unencumbered assets that would serve to protect the preferred shareholders’ interests in even the most dire scenarios.

These are not the highest-yielding picks in today’s market, these are three very conservative preferred shares for long-term investors. These are picks that in normal conditions would be trading well above par, but thanks to indiscriminate panic, investors can catch them at a discount.